Moving average convergence divergence (MACD) is a trend indicator that is calculated using difference between 12 and 26 day exponential price average (EPA) and tells whether a stock is in an uptrend or downtrend. An exponential moving average is a type of moving average that is similar to a simple moving average, except that more weight is given to the latest data. MACD is extremely helpful in spotting increasing short term momentum

A positive MACD line 1 value is caused when 12 day EPA is greater than 26 day EPA. This indicates increasing upward momentum. An increasing negative MACD line 1 output indicates that the downward trend is getting stronger.

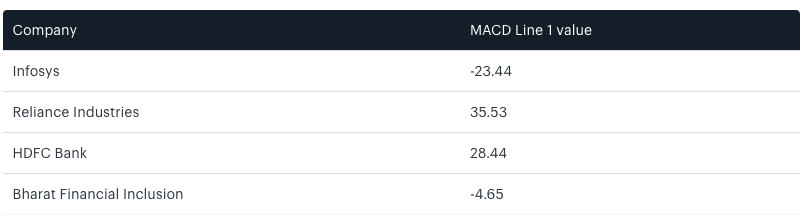

As can be seen from the table above Reliance Industries and HDFC Bank have positive MACD line 1 values indicating short term uptrend in the stocks. In case of Infosys and Bharat Financial Inclusion the line 1 value is negative indicating that stock are in down trend.

As can be seen from the table above Reliance Industries and HDFC Bank have positive MACD line 1 values indicating short term uptrend in the stocks. In case of Infosys and Bharat Financial Inclusion the line 1 value is negative indicating that stock are in down trend.